Secured and Unsecured Taxes

What is the difference?

Taxes! The bane of our lives! Federal income tax, State income tax, property tax, sales tax, use tax, transfer tax, if the government can find a name for it, they will try to vote it in. However, without taxes, we would not be able to fund our infrastructure. Property taxes, in particular, functions as a watershed for funds that make the community a viable one.

First and foremost it is important to understand that the State of California has different state agencies for different parts of the assessment, determination and collection of taxes.

- The County Tax Assessor – assesses and determines the value of the property

- The County Auditor-Controller – receives the assessment information from the Assessor’s office and applies the correct tax rates to determine the actual amount of taxes to be paid. (They also allocate the funds to the local taxing agencies, cities, schools, special districts, bonds voted in, etc)

- The County Tax Collector – issues the tax bills and collects payments

- California Dept of Tax & Fee Administration – reviews assessment appeals

Simplified, there are two types of taxes:

- Secured Taxes – Taxes that are secured on the real property itself

- Unsecured Taxes – Taxes that are levied against anything other than real property. This includes Personal Property Tax, which is levied against business’ equipment, boats and aircraft.

Secured Taxes

Secured property taxes are, by far, the most important and revenue generating taxes. They are assessed on every single piece of real property in the State of California, no matter its type, usage or location.

Proposition 13 – In June of 1978 California voters passed this proposition which froze property values to their 1976 assessed value and only allowed an increase each year by no more than 2% of the previous bill. However, once the property is sold or transferred, then the Assessor’s office will be free to do a reassessment. Once the reassessment is done, the taxes are then only allowed to increase each year by no more than 2% of the previous bill, no matter if the actual property values increases by leaps and bounds .

Assessment is based on 1% of the sales price, or the current market value, with future yearly increases capped at 2%. Added to that are the additional amounts voted in by local cities, counties, schools districts, special assessment and bonds. An escrow officer or a lender who wishes to approximate the amount of regular taxes usually use 1.25% – 1.5% of the sales price. Some areas may be higher.

Throughout the year the Assessors get notification of the transfer of ownership which will then trigger the re-assessment. We advise our clients that it will take about 4 months for the re-assessment to be completed and the County Tax Collector to send out a bill for the reassessments through supplemental tax bills. We always remind our clients that the supplements are in addition to the regular taxes that were originally assessed and not inclusive of.

Throughout the year the Assessors may also send out escaped tax bills. These are taxes that may have escaped their notice and thus they are backtracking. This used to happen a lot in those years when property sale turnovers were going fast and furious and the Assessors had a difficult time catching up in a timely manner.

Unsecured taxes- Personal Property Taxes

Unsecured taxes are those assessed against movable (personal) property and normally applies to the equipment that is used in the operation of a business. If you own a business and the cost of the furniture, fixtures, equipment, exceeds $100,000, then you will need to declare their values determined on January 1 of the year on the Business Personal Property Statement (Form 571-L), to be returned no later than April 1. The Assessor will determine your next year’s unsecured personal property tax amounts based on the 571-L form.

Unsecured taxes – Other

There are times when escaped property taxes come out when the real property has already been sold. These escaped assessments, instead of being secured on the real property because the property has already changed hands, will be put on the unsecured tax roll against the previous owner. Often this can be found in new construction where the Builder’s taxes are re-assessed based on completion of the building but the property was sold immediately after completion. There may be other reasons for the escaped assessments, and they will be put on the unsecured tax roll, which means that will come up whenever this taxpayor’s name is researched in the County index files.

Boats and aircrafts? Yes, they also have their own personal property taxes.

Manufactured Homes

To further complicate the plot we have Manufactured Homes, also known as mobile homes. If the mobile home has been secured to the land via a permanent foundation, then their taxes are assessed by the County Assessor’s office and will go on the Secured property tax roll. If the mobile home is not on a permanent foundation and it can be moved from location to location, then they are treated as an automobile and they are licensed and taxed by the Department of Motor Vehicles.

Exclusions

The Assessor must reassess every time the ownership transfers, but there are certain exclusions that can be put in place if the ownership transfer is due to reasons other than a real sale.

The Revenue and Taxation Code (R & T) lists a number of exclusions which are used as a guideline to what the Assessor’s office may. Here is a list:

- This is a gift transfer between parents and children, grandparents and grandchildren and the grantor did not receive any compensation. R & T 11911.

- This is a transfer between spouses or domestic partners due to divorce, death, removal of one spouse. R & T 11911 or R & T 11927.

- This is a transfer that puts the property into or takes it out of a Living Trust or an Irrevocable Trust, that benefits the transferors or the creator of the Trusts., R & T 11930

- This transfer confirms the death of a person who was on title as a Joint Tenant. R & T 11911

- The grantors and the grantees in the conveyance are comprised of the same parties who continue to hold the same proportionate interest in the property, R & T 11923 (d)

- This is a transfer that only corrects or confirms a change of name, and the grantor and grantee are the same parties. R & T 11911

- This is a court-ordered conveyance or decree that is not pursuant to sale. R & T 11911

- The transfer is done to create or terminate a Lender’s interest. R & T 11921

- The transfer is done for financing purposes to add or remove a co-signer. R & T 11921

- This is a transfer between parties in which the proportional interests between the transferors and transferees remain exactly the same after the transfer. R & T 11911.

- The transfer replaces a principal residence of a severely disabled person

- The transfer replaces a principal residence by a person over 55 years old

- You are a disabled veteran or spouse of a disabled veteran.

- The property purchased has government subsidized low income housing requirements

- This is a first time buyer of a new property that has an active solar energy system

- The property purchased has a lease term of over 35 years

All these exclusions can be found on the front page of the Preliminary Change of Ownership form (BOE-502-A). This form is submitted to the County Recorder’s office together with the ownership transfer deed which is then transmitted to the Assessor’s so that determination can be made as to the reason for the transfer and whether a reassessment exclusion can apply.

The exclusions are not automatic, even when the proper box is marked on the form. For instance, exclusions stated above – #1, #2, #4, #13, #15 – will need separate claim forms to be submitted. In addition, the Assessor may question any of the exclusions requested and demand that the taxpayer provide them with proof.

The assessment and payment of property taxes can be a huge headache for the Buyer and it is hard to understand. Settlement Agents are the natural recipients of their questions because we make sure that the taxes are paid and prorated between parties through the transaction. This is why this article exists!

Here are some important facts:

- Every time the property changes hands, the Assessor’s office will look to re-assess the value to the current market value.

- If you use the property as a principal residence, they will exempt $7,000 from the assessed value. A claim has to be filed to obtain this Homeowners Exemption and this exemption can only apply to one property at any given time. Vacation homes are not considered the principal residence unless you declare it.

- The state wide base tax is 1% of the assessed value. You add the incidental county, city, school and other bonds and improvements and the the percentage goes up by .25 to .50%

- If the Assessor’s office sees that the sales price or designated value of the property is much less than the comparable current values in that area, they will base their assessments on what they deem is the correct value.

- Property taxes run on a fiscal year of July 1 to June 30 of the next year.

- Regular yearly tax bills are issued only once a year and are mailed out around October of each year to the name and address of the owner of the property as of January 1 of that year. It can be paid all at one time, or in two installments.

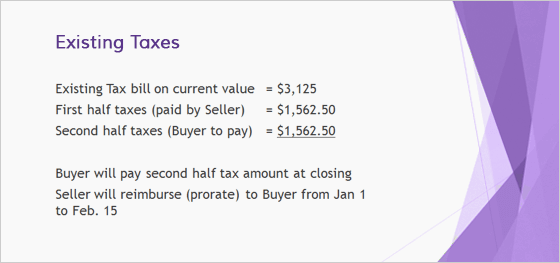

- Due date of regular tax bill installments are: 1st half taxes – November 1 due and delinquent if not paid by December 10. They cover taxes from July 1 to December 31.

- 2nd half taxes – February 1 due and delinquent if not paid by April 10. they cover taxes from January 1 to June 30.

- Penalties will be due if you don’t payments are not postmarked by December 10 and April 10.

- Supplement tax bills come out approximately 4 months after the property transfers ownership. This bill is separate from the regular tax bills.

- If the transfer of the property takes place around the time that the fiscal year end of June 30 happens, you may get two supplement bills, one for the fiscal year ending June 30 and the other for the fiscal year that starts July 1.

- Escaped tax bills and unsecured tax bills can come out anytime.

- Impounds for taxes – If you have a new loan and the Lender is collecting and paying your property taxes for you, you have an “impound account”, sometimes also referred to “escrow account”. This is solely a Lender term and requirement and has nothing to do with an actual escrow transaction to purchase and sell. Lenders will collect advance amounts through the escrow transaction to make sure that they have sufficient funds to pay these taxes when they become due. They will pay all your regular taxes that first year; but WILL NOT pay any of the supplement taxes that are issued thereafter. These supplement taxes have to be paid out of pocket by you.

- Personal property tax bills for business equipment comes out once a year, sometime between March 1 and June 30 and become delinquent if not paid by August 31. Like the secured property tax bill, they encompass taxes from July 1 of one year to June 30 of the next year. Unlike secured property tax bills, these payments are paid in one payment every year.

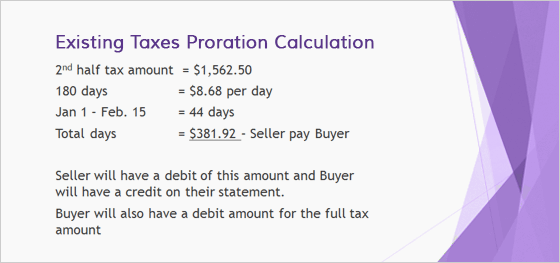

- Prorations are the calculation of an amount in escrow so that each party pays their share of a whole bill. Prorations of taxes is standard at the closing and will show that each party pays or receives back from amounts already paid.

- Unless specifically agreed upon between Buyer and Seller, all taxes are prorated in escrow on a 360 day year or 180 day half year. The day of closing does not count into proration.

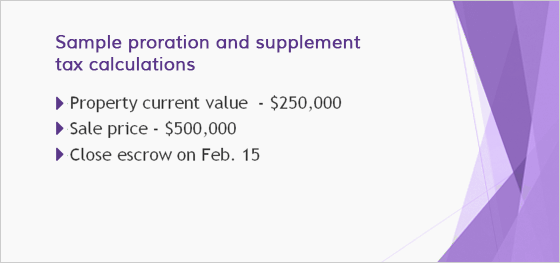

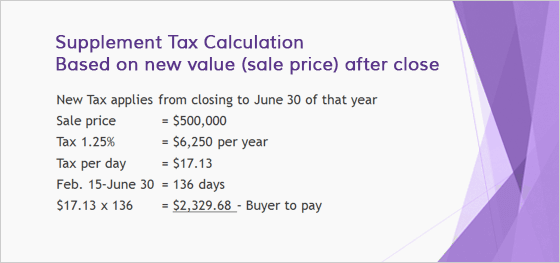

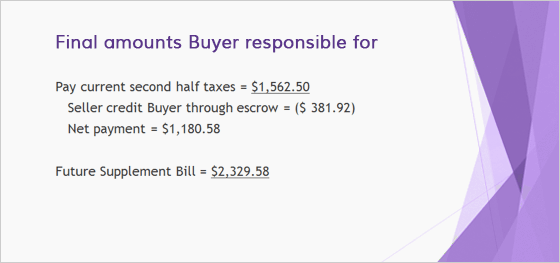

Here is a sample of how prorations are calculated on existing regular and supplement taxes in a transaction:

Questions asked us and Answers given

Q: Why is it important that the Preliminary Change of Ownership form (PCOR) (BOE-502-A) be filled out completely?

A: The Preliminary Change of Ownership form, or PCOR, is handed to the Buyer in an escrow transaction to be completed. This form has to be attached to and filed with each transfer of ownership form, like a Grant Deed, a Quitclaim Deed, or even an Affidavit of Death. A small penalty is added to the recording fee if the form is not attached.

The information requested is important for the assessment process and gives the Assessor an idea of the nature of the transfer, if any exclusion from reassessment can apply, and where the future tax bills should be sent. Some of the salient points:

Mailing address to be used –

Where do you want your tax bill mailed to? Stating that the tax bill was not received because it had the wrong address will not be accepted as a reason for the removal of a late payment penalty. It is your responsibility to make sure that the correct mailing address is inserted in the PCOR. It is also very important to use an address in the U.S. The Tax Collector’s office will not put additional stamps so that the mail can be sent internationally.

Purchase price –

To be correctly assessed the correct purchase price of the property should be inserted. The Assessor also has the means to match the written purchase price versus the amount of transfer tax paid on the transfer deed.

Exclusions –

If there are exclusions that you can take advantage of, this is where you make it known. Some of the exclusions will need you to submit additional claim forms

Use of property – principal residence –

If this will be your principal residence then this is the form on which notification is first given to the Assessor and a $7,000 exemption will be reflected on the tax bill.

Q: What is the difference between the Preliminary Change of Ownership (PCOR) form and the Change of Ownership form (COS) (BOE-502-AH)?

A: There isn’t much difference between the two forms but it was created under two different statutes. If the PCOR form was not filed with the transfer deed, or the information was not completed, then the Assessor will send out the COS form as a requirement. Within 90 days from receipt the form must be completed or a penalty will be assessed of $100 or 10% of the tax value, whichever is greater, not exceeding $5,000. The penalty becomes $20,000 in cases where the property is not the principal residence. If you do receive a Change of Ownership form, please do not disregard it but fill it in completely and send it back immediately

Q: What if you purchased the property for a value much less than what it was originally? Will the Assessor lower the value?

A: This is a question that the County Assessor will need to answer and yes, there is an appeal process that you can go through. You start with filing an Assessment Appeal Application (form BOE-305-AH) with the Assessor’s office. You will need to provide proof of why you feel that the value is much less.

For your information, if this is a distress sale and the price of the property has been reduced considerably to enable it to be sold, or if this is a transfer between family members and the value of the property does not match the values in the surrounding area, using the sale price as a general guideline for the eventual reassessment might not work.

Q: Are all the taxes that show on the preliminary title report paid and prorated between Buyer and Seller?

A: The preliminary title report will show certain different taxes:

Current taxes – paid or unpaid

Supplement taxes – paid or unpaid

Delinquent Taxes – unpaid

When a Settlement Agent processes a file the first thing that comes to their attention is the matter of taxes. 90% of the time the current taxes must be paid at closing. If the transaction is closing when the first half taxes must be paid, then we will do so and we leave the second half unpaid and remind the new owner to pay them when they become due.

Example: The transaction is closing on November 30, which means that the current first half taxes that are due on November 1 and delinquent December 10 will be paid in escrow, either from the Seller or the Buyer, and the corresponding credit proration given to the other party. We will advise the new owner to pay the second half which is due February 1 and delinquent if unpaid by April 10.

Example: If the transaction is closing on February 15, we will make sure that the second half, which should be paid on February 1 and delinquent if unpaid by April 10, is paid through the closing from the Seller or the Buyer and the corresponding credit proration given to the other party.

When supplement taxes are shown, we will make sure those are paid and, depending if the supplements are for the present fiscal year, it will be included in the proration between parties. However, if the supplements are for a previous year, then the full amounts will be paid by the Seller, and there will be NO proration between Seller and Buyer.

Delinquent taxes will be updated for penalty increases and paid from the Seller’s proceeds at closing. There will be no proration between Seller and Buyer.

Q: What if the new tax bill for the current fiscal year has not come out and escrow has to close? What do you use as figures?

A: Property Tax fiscal year starts July 1 of one year and ends June 30 of the next year. The actual tax payment bill is sent out around the first half of October. If the transaction is closing before the new tax bill is issued then the Settlement Agent can only prorate based on the latest amounts known, which are the tax amounts for the last fiscal tax year. Please note that it is written in the General Provisions of our Escrow Instructions that we will handle the matter this way.

Normally there is no “re-proration” of the tax amount after the closing once the new bill is received, especially if the difference between the old and the new is very minimal. If there is a huge difference then such a request should be submitted to the Settlement Agent, who will then get the approval from both parties to do so.

Q: Are unsecured personal property taxes belonging to a business prorated at closing?

A: Yes. Unsecured property taxes assessed to a business for the furniture, equipment that is used in the operation of the business are also prorated at closing. When we process a Business Opportunity sale (Bulk Sale) under the UCC Code, we will record and publish a Notice to Creditors. At the same time we have to alert the County Tax Collector of the sale so that they will send us any amounts that are owed by the business as well as the last tax payment amount. We will use this amount for proration purposes and if requested by the Tax Collector, we will pre-pay the next year’s taxes for the new owner, as long as they give us an amount.

These business unsecured taxes are issued and paid once a year so any proration will be for the year and not a half-year.

Q: A preliminary title report on the sale of my property shows a Certificate of Lien under my name and my Settlement Agent says that this might be an unsecured property tax bill that was not paid?

A: Yes, it probably is. There is usually an address on the Certificate of Tax Lien that points to the address of where the unsecured taxes were assessed. This Lien is recorded against you and that location and so it will come up if you sell the business or any properties that you own.

Q: If I own 50% of a property with a partner and I sell my 50%, will the re-assessment apply?

A: Unfortunately, yes, there will be a re-assessment of the 50% that is sold, no matter if it was sold to your partner or to some other person.

Q: Can you describe in more detail what Supplement Taxes are?

A: The San Diego County Tax Collector has put forth a very well done video on this particular subject matter. Go to this link for a very concise description on what those taxes are.

We hope this article has been of interest to you. It is important that you choose a Settlement Agent who can bring his/her knowledge and experience to your transaction.

Do you have any other questions or concerns that you would like to bring up? Be sure you go to to “Ask Juliana” and put in your question. Or, sign up to join our Viva Escrow Community and look to see what questions other people may have!

Juliana Tu, CSEO, CEO, CBSS, CEI, SASIP

Escrow Manager

Good news! “The Art of Escrow” is out! Look for it on www.amazon.com!

The Art of Escrow:

The Fight For Your American Dream and the Pursuit of Homeownership

Available now at Amazon.com

- Threats to Escrow – Part 5 – Document Fraud! - May 19, 2023

- When the Loan Got Sold and You Just Closed Escrow - April 6, 2020

- Mechanics Lien - October 7, 2019

- Are You a Foreigner and Need to Know About U.S. FIRPTA Withholding Laws? - February 20, 2019

- When the FIRPTA

Withholding Goes Wrong - February 20, 2019

Join Our FREE Viva Escrow Forums